Leading the AI way, Responsibly

Discover our security standards and compliance commitments.

We care about your data

Never Stored Or Used For Learning Purposes

Your data is never persisted at the LLM level, and never used for future reference or learning by the model.

Isolated And Separated From Others

Each customer's data and resources are secluded in a single-tenant environment, separate from other users.

Locked Up Tight For Ultimate Privacy

Strong encryption protocols are employed to safeguard all customer data.

We are certified secure

Reports may be provided upon request

We are compliant since day one

Full Data Lineage Provided

Sixfold is engineered to offer complete visibility into the origins of data used by our system, detailing its processing journey and utilization within our model.

Transparent Model Training

We meticulously document the development of our AI model, including its training methodologies, the algorithms employed, and the settings adjusted throughout its training phase.

Traceable And Explainable Sources

Our platform ensures all conclusions can be verified, incorporating an additional layer in the review process to confirm that summaries are reasonable, relevant, and compliant with guidelines.

Designed To Meet Regulations

In response to emerging regulations that demand AI systems to be both transparent and explainable, our product's foundational design embodies these principles.

Human Oversight Guaranteed

Our team actively monitors the platform's output, ready to investigate and rectify any anomalies, ensuring our commitment to reliability and accuracy.

We are different than off-the-shelf AI

Sixfold stands out from general-purpose AI solutions by ensuring your data and information remain secure and confidential within your organization

Discover all the ways we differ on safety measures:

Product Comparison

Off-the-shelf AI tools

Customers have dedicated single-tenant environments

Yes

No

Customers maintain ownership and control over their data

Yes

No

Data trains client-specific models, not generic LLMs

Yes

No

Designed to meet industry-specific privacy laws and regulations

Yes

No

In-depth transparency into the algorithms used

Yes

No

Custom data-retention rules to match your data governance

Yes

No

We develop relevant narratives

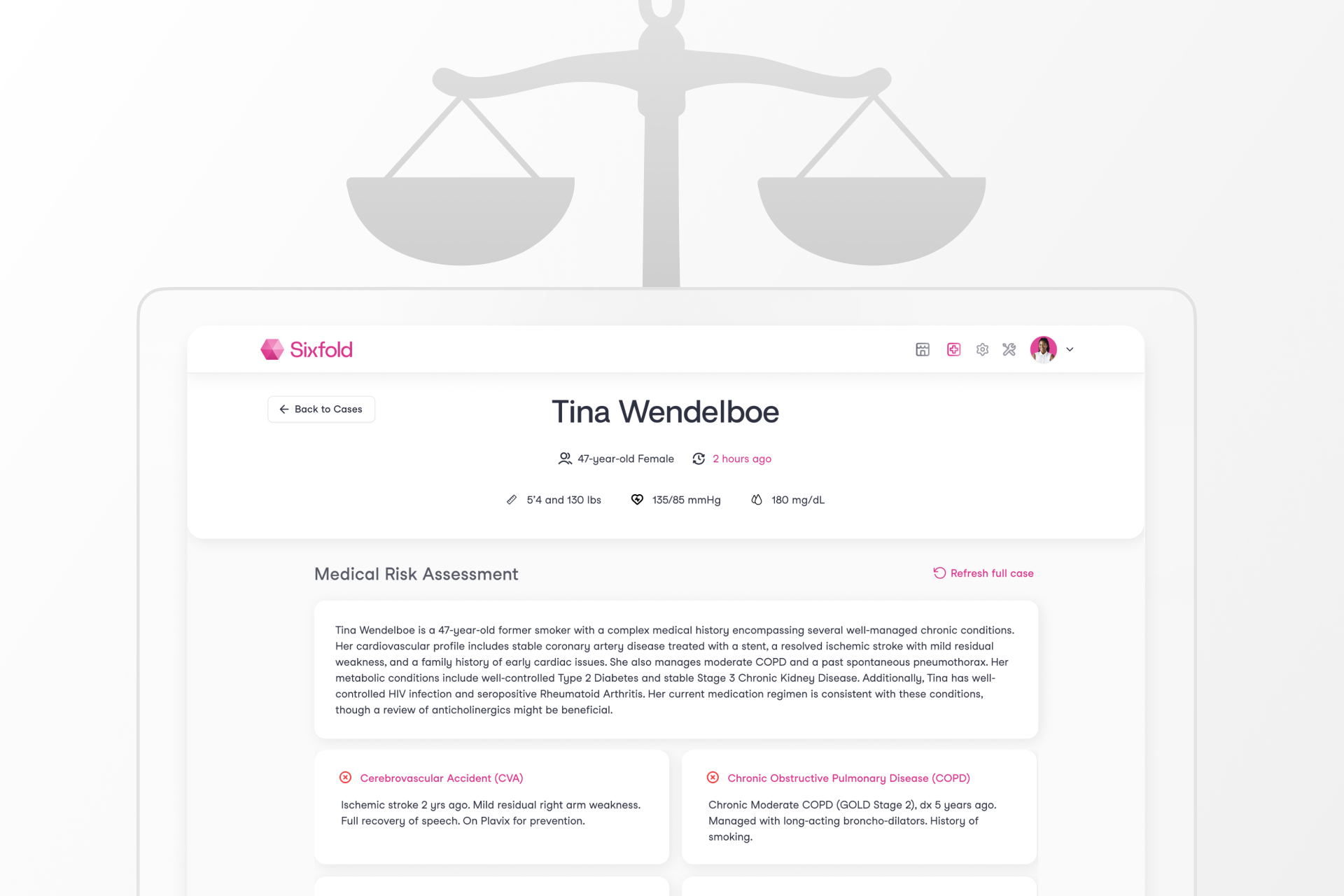

Sixfold's Approach to AI Fairness & Bias Testing

As AI becomes more embedded in insurance underwriting, ensuring fairness is a shared responsibility across carriers, vendors, and regulators. Sixfold's commitment to responsible AI means continuously exploring new ways to evaluate bias.

As AI becomes more embedded in the insurance underwriting process, carriers, vendors, and regulators share a growing responsibility to ensure these systems remain fair and unbiased.

At Sixfold, our dedication to building responsible AI means regularly exploring new and thoughtful ways to evaluate fairness.1

We sat down with Elly Millican, Responsible AI & Regulatory Research Expert, and Noah Grosshandler, Product Lead on Sixfold's Life & Health team, to discuss how Sixfold is approaching fairness testing in a new way.

Fairness As AI Systems Advance

Fairness in insurance underwriting isn’t a new concern, but testing for it in AI systems that don’t make binary decisions is.

At Sixfold, our Underwriting AI for life and health insurers don’t approve or deny applicants. Instead, it analyzes complex medical records and surface relevant information based on each insurer's unique risk appetite. This allows underwriters to work much more efficiently and focus their time on risk assessment, not document review.

“We needed to develop new methodologies for fairness testing that reflect how Sixfold works.”

— Elly Millican, Responsible AI & Regulatory Research Expert

While that’s a win for underwriters, it complicates fairness testing. When your AI produces qualitative outputs such as facts and summaries, rather than scores and decisions, most traditional fairness metrics won’t work. Testing for fairness in this context requires an alternative approach.

“The academic work around fairness testing is very focused on traditional predictive models, however Sixfold is doing document analysis,” explains Millican. “We needed to develop new methodologies for fairness testing that reflect how Sixfold works.”

“The academic work around fairness testing is very focused on traditional predictive models, however Sixfold is doing document analysis,” explains Millican. “We needed to develop new methodologies for fairness testing that reflect how Sixfold works.”

“Even selecting which facts to pull and highlight from medical records in the first place comes with the opportunity to introduce bias. We believe it’s our responsibility to test for and mitigate that,” Grosshandler adds.

While regulations prohibit discrimination in underwriting, they rarely spell out how to measure fairness in systems like Sixfold’s. That ambiguity has opened the door for innovation, and for Sixfold to take initiative on shaping best practices and contributing to the regulatory conversation.

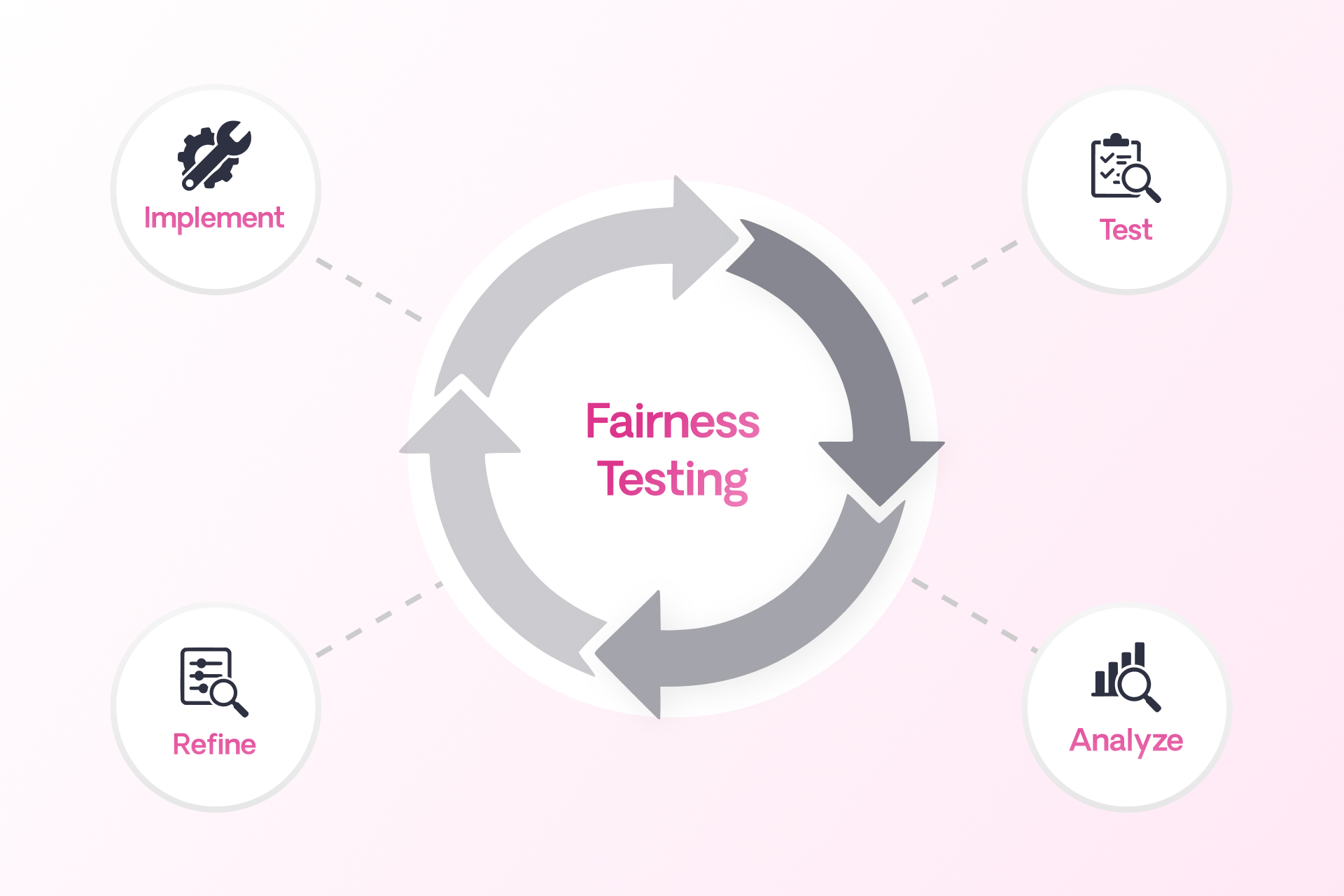

A New Testing Methodology

To address the challenge of fairness testing in a system with no binary outcomes, Sixfold is developing a methodology rooted in counterfactual fairness testing. The idea is simple: hold everything constant except for a single demographic attribute and see if and how the AI’s output changes.2

“Ultimately we want to validate that medically similar cases are treated the same when their demographic attributes differ,”

— Noah Grosshandler, Product Manager @Sixfold

“We start with an ‘anchor’ case and create a ‘counterfactual twin’ who is identical in every way except for one detail, like race or gender. Then we run both through our pipeline to see if the medical information that’s presented in Sixfold varies in a notable or concerning way” Millican explains.

“Ultimately we want to validate that medically similar cases are treated the same when their demographic attributes differ,” Grosshandler states.

Proof-of-Concept

For the initial proof-of-concept, the team is focused on two key dimensions of Sixfold’s Life & Health pipeline.

1. Fact Extraction Consistency

Does Sixfold extract the same facts from medically identical underwriting case records that differ only in one protected attribute?

2. Summary Framing and Content Consistency

Does Sixfold produce diagnosis summaries with equivalent clinical content and emphasis for medically identical underwriting cases?

“It’s not just about missing or added facts, sometimes it’s a shift in tone or emphasis that could change how a case is perceived,” Millican explains. “We want to be sure that if demographic details are influencing outputs, it’s only when clinically appropriate. Otherwise, we risk surfacing irrelevant information that could skew decisions.”

Expanding the Scope

While the team’s current focus is on foundational fairness markers (race and gender), the methodology is designed to evolve. Future testing will likely explore proxy variables such as ZIP codes, names, and socioeconomic indicators, which might implicitly shape model behavior.

“We want to get into cases where the demographic signal isn’t explicit, but the model might still infer something. Names, locations, insurance types, all of these could serve as proxies that unintentionally influence outcomes,” Millican elaborates.

The team is also thinking ahead to version control for prompts and model updates, ensuring fairness testing keeps pace with an evolving AI stack.

“We’re trying to define what fairness means for a new kind of AI system,” explains Millican. “One that doesn’t give a single output, but shapes what people see, read, and decide.”

Sixfold isn’t just testing for fairness in isolation, it’s aiming to contribute to a broader conversation on how LLMs should be evaluated in high-stakes contexts like insurance, healthcare, finance, and more.

That’s why Sixfold is proactively bringing this work to the attention of regulatory bodies. By doing so, we hope to support ongoing standards development in the industry and help others build responsible and transparent AI systems.

“This work isn’t just about evaluating Sixfold, it’s about setting new standards for a new category of AI." Grosshandler concludes.

“This work isn’t just about evaluating Sixfold, it’s about setting new standards for a new category of AI. Regulators are still figuring this out, so we’re taking the opportunity to contribute to the conversation and help shape how fairness is monitored in systems like ours,” Grosshandler concludes.

Positive Regulatory Feedback

When we recently walked through our testing methodology and results with a group of regulators focused on AI and data, the feedback was both thoughtful and encouraging. They didn’t shy away from the complexity, but they clearly saw the value in what we’re doing.

“The fact that it’s hard shouldn’t be a reason not to try. What you’re doing makes sense... You’re scrutinizing something that matters.” said one senior policy advisor.

“The fact that it’s hard shouldn’t be a reason not to try. What you’re doing makes sense... You’re scrutinizing something that matters.”

— Senior Policy Advisor

One of the key themes that came up during the meeting was the unique nature of generative AI, and why it demands a different kind of oversight. As one senior actuary and behavioral data scientist put it: “Large language models are more qualitative than quantitative... A lot of technical folks don’t really get qualitative. They’re used to numbers. The more you can explain how you test the language for accuracy, the more attention it will get.”

That comment really resonated. It reflects the heart of our approach, we’re not just tracking metrics. We’re evaluating how language evolves, how facts can shift, and how risk is framed and communicated depending on the inputs.

The Road Ahead

Fairness in AI isn’t a fixed destination, it’s an ongoing commitment. Sixfold’s work in developing and refining fairness and bias testing methodologies reflects that mindset.

As more organizations turn to LLMs to analyze and interpret sensitive information, the need for thoughtful, domain-specific fairness methods will only grow. At Sixfold, we’re proud to be at the forefront of that work.

Footnotes

1While internal reviews have not surfaced evidence of systemic bias, Sixfold is committed to continuous testing and transparency to ensure that remains the case as we expand and refine our AI systems.

2To ensure accuracy, cases involving medically relevant demographic traits, like pregnancy in a gender-flipped case, are filtered out. The methodology is designed to isolate unfair influence, not obscure legitimate medical distinctions.

.png)

AI Vendor Compliance: A Practical Guide for Insurers

In the hands of insurers, AI can drive great efficiency —safely and responsibly. We recently sat down with Matt Kelly, Data Strategy & Security expert and counsel at Debevoise & Plimpton, to explore how insurers can achieve this.

In the hands of insurers, AI can drive great efficiency —safely and responsibly. We recently sat down with Matt Kelly, Data Strategy & Security expert and counsel at Debevoise & Plimpton, to explore how insurers can achieve this.

Matt has played a key role in developing Sixfold’s 2024 Responsible AI Framework. With deep expertise in AI governance, he has led a growing number of insurers through AI implementations as adoption accelerates across the insurance industry.

To support insurers in navigating the early stages of compliance evaluation, he outlined four key steps:

Step 1: Define the Type of Vendor

Before getting started, it’s important to define what type of AI vendor you’re dealing with. Vendors come in various forms, and each type serves a different purpose. Start by asking these key questions:

- Are they really an AI vendor at all? Practically all vendors use AI (or will do so soon) – even if only in the form of routine office productivity tools and CRM suites. The fact that a vendor uses AI does not mean they use it in a way that merits treating them as an “AI vendor.” If the vendor’s use of AI is not material to either the risk or value proposition of the service or software product being offered (as may be the case, for instance, if a vendor uses it only for internal idea generation, background research, or for logistical purposes), ask yourself whether it makes sense to treat them as an AI vendor at all.

- Is this vendor delivering AI as a standalone product, or is it part of a broader software solution? You need to distinguish between vendors that are providing an AI system that you will interact with directly, versus those who are providing a software solution that leverages AI in a way that is removed from any end users.

- What type of AI technology does this vendor offer? Are they providing or using machine learning models, natural language processing tools, or something else entirely? Have they built or fine-tuned any of their AI systems themselves, or are they simply built atop third-party solutions?

- How does this AI support the insurance carrier’s operations? Is it enhancing underwriting processes, improving customer service, or optimizing operational efficiency?

Pro Tip: Knowing what type of AI solution you need and what the vendor provides will set the stage for deeper evaluations. Map out a flowchart of potential vendors and their associated risks.

Step 2: Identify the Risks Associated with the Vendor

Regulatory and compliance risks are always present when evaluating AI vendors, but it’s important to understand the specific exposures for each type of implementation. Some questions to consider are:

- Are there specific regulations that apply? Based on your expected use of the vendor, are there likely to be specific regulations that would need to be satisfied in connection with the engagement (as would be the case, for instance, with using AI to assist with underwriting decisions in various jurisdictions)?

- What are the data privacy risks? Does the vendor require access to sensitive information – particularly personal information or material nonpublic information – and if so, how do they protect it? Can a customer’s information easily be removed from the underlying AI or models?

- How explainable are their AI models? Are the decision-making processes clear, are they well documented, and can the outputs be explained to and understood by third parties if necessary?

- What cybersecurity protocols are in place? How does the vendor ensure that AI systems (and your data) are secure from misuse or unauthorized access?

- How will things change? What has the vendor committed to do in terms of ongoing monitoring and maintenance? How will you monitor compliance and consistency going forward?

Pro Tip: A good approach is to create a comprehensive checklist of potential risks for evaluation. For each risk that can be addressed through contract terms, build a playbook that includes key diligence questions, preferred contract clauses, and acceptable backup options. This will help ensure all critical areas are covered and allow you to handle each risk with consistency and clarity.

Step 3: Evaluate How Best to Mitigate the Identified Risks

Your company likely has processes in place to handle third-party risks, especially when it comes to data protection, vendor management, and quality control. However, not all risks may be covered, and they may need new or different mitigations. Start by asking:

- What existing processes already address AI vendor risks? For example, if you already have robust data privacy policies, consider whether those policies cover key AI-related risks, and if so, ensure they are incorporated into the AI vendor review process.

- Which risks remain unresolved? Identify the gaps in your current processes to identify unique residual risks – such as algorithmic biases or the need for external audits on AI models – that will require new and ongoing resource allocations.

- How can we mitigate the residual risks? Rather than relying solely on contractual provisions and commercial remedies, consider alternative methods to mitigate residual risks, including data access controls and other technical limitations. For instance, when it comes to sharing personal or other protected data, consider alternative means (including the use of anonymized, pseudonymized, or otherwise abstracted datasets) to help limit the exposure of sensitive information.

Pro Tip: You don’t always need to reinvent the wheel. Look at existing processes within your organization, such as those for data privacy, and determine if they can be adapted to cover AI-specific risks.

Step 4: Establish a Plan for Accepting and Governing Remaining Risks

Eliminating all AI vendor risks cannot be the goal. The goal must be to identify, measure, and mitigate AI vendor risks to a level that is reasonable and that can be accepted by a responsible, accountable person or committee. Keep these final considerations in mind:

- How centralized is your company’s decision-making process? Some carriers may have a centralized procurement team handling all AI vendor decisions, while others may allow business units more autonomy. Understanding this structure will guide how risks are managed.

- Who is accountable for evaluating and approving these risks? Should this decision be made by a procurement team, the business unit, or a senior executive? Larger engagements with greater risks may require involvement from higher levels of the company.

- Which risks are too significant to be accepted? In any vendor engagement, some risks may simply be unacceptable to the carrier. For example, allowing a vendor to resell policyholder information to third parties would often fall into this category. Those overseeing AI vendor risk management usually identify these types of risks instinctively, but clearly documenting them helps ensure alignment among all stakeholders, including regulators and affected parties.

One-Process-Fits-All Doesn’t Apply

As AI adoption grows in insurance, taking a strategic approach can help simplify review processes and prioritize efforts. These four steps provide the foundation for making informed, secure decisions from the start of your AI implementation project.

Evaluating AI vendors is a unique process for each carrier that requires clarity about the type of vendor, understanding the risks, identifying the gaps in your existing processes, and deciding how to mitigate the remaining risks moving forward. Each organization will have a unique approach based on its structure, corporate culture, and risk tolerance.

“Every insurance carrier that I’ve worked with has its own unique set of tools and rules for evaluating AI vendors, what works for one may not be the right fit for another.”

- Matt Kelly, Counsel at Debevoise & Plimpton.

6 Common Myths About AI, Insurance, and Compliance

I run into the same misconceptions about AI and insurance again and again. Let me try to put some of these common myths to bed once and for all.

These days, my professional life is dedicated to one focused part of the global business landscape: the untamed frontier where cutting-edge AI meets insurance.

I have conversations with insurers around the world about where it’s all going and how AI will work under new global regulations. And one thing never ceases to amaze me: how often I end up addressing the same misconceptions.

Some confusion is understandable (if not inevitable) considering the speed with which these technologies are evolving, the hype from those suddenly wanting a piece of the action, and some fear-mongering from an old guard seeking to maintain the status quo. So, I thought I’d take a moment to clear the air and address six all-too-common myths about AI in insurance.

Myth 1: You’re not allowed to use AI in insurance

Yes, there’s a patchwork of emerging AI regulations—and, yes, in many cases they do zero-in specifically on insurance—but they do not ban its use. From my perspective, they do just the opposite: They set ground rules, which frees carriers to invest in innovation without fear they are developing in the wrong direction and will be forced into a hard pivot down the line.

Sixfold has actually increased customers (by a lot) since the major AI regulations in Europe and elsewhere were announced. So, let’s put this all-too-prevalent misconception to bed once and for all. There are no rules prohibiting you from implementing AI into your insurance processes.

Myth 2: AI solutions can’t secure customer data

As stated above, there are no blanket prohibitions on using customer data in AI systems. There are, however, strict rules dictating how data—particularly PII and PHI—must be managed and secured. These guidelines aren’t anything radically new to developers with experience in highly regulated industries.

Security-first data processes have been the norm since long before LLMs went mainstream. These protocols protect crucial personal data in applications that individuals and businesses use every day without issue (digital patient portals, browser-based personal banking, and market trading apps, just to name a few). These same measures can be seamlessly extended into AI-based solutions.

Myth 3: “My proprietary data will train other companies’ models”

No carrier would ever allow its proprietary data to train models used by competitors. Fortunately, implementing an LLM-powered solution does not mean giving up control of your data—at least with the right approach.

A responsible AI vendor helps their clients build AI solutions trained on their unique data for their exclusive use, as opposed to a generic insurance-focused LLM to be used by all comers. This also means allowing companies to maintain full control over their submissions within their environment so that when, for example, a case is deleted, all associated artifacts and data are removed across all databases.

At Sixfold, we train our base models on public and synthetic (AKA, “not customer”) data. We then copy these base models into dedicated environments for our customers and all subsequent training and tuning happens in the dedicated environments. Customer guidelines and data never leave the dedicated environment and never make it back to the base models.

Let’s kill this one: Yes, you can use AI and still maintain control of your data.

Myth 4: There’s no way to prevent LLM hallucinations

We’ve all seen the surreal AI-generated images lurching up from the depths of the uncanny valley—hands with too many fingers, physiology-defying facial expressions, body parts & objects melded together seemingly at random. Surely, we can’t use that technology for consequential areas like insurance. But I’m here to tell you that with the proper precautions and infrastructure, the impact of hallucinations can be greatly minimized, if not eliminated.

Mitigation is achieved using a myriad of tactics such as using models to auto-review generated content, incorporating user feedback to identify and correct hallucinations, and conducting manual reviews to ensure quality by comparing sample outputs against ground truth sets.

Myth 5: AIs run autonomously without human oversight

Even if you never watched The Terminator, The Matrix, 2001: A Space Odyssey, or any other movie about human-usurping tech, it’d be reasonable to have some reservations about scaled automation. There’s a lot of fearful talk out there about humans ceding control in important areas to un-feeling machines. However, that’s not where we’re at, nor is it how I see these technologies developing.

Let’s break this one down.

AI is a fantastic and transformative technology, but even I—the number one cheerleader for AI-powered insurance—agree we shouldn’t leave technology alone to make consequential decisions like who gets approved for insurance and at what price. But even if I didn’t feel this way, insurtechs are obliged to comply with new regulations (e.g., the EU AI Act and the California Department of Insurance), that tilt towards avoiding fully automated underwriting and require, at the very least, that humans overseers can audit and review decisions.

When it comes to your customers’ experience, AI opens the door to more human engagement, not less. In my view, AI will free underwriters from banal, repetitive data work (which machines handle better anyway) so that they can apply uniquely human skills in specialized or complex use cases they previously wouldn’t have had the bandwidth to address.

Myth 6: Regulations are still being written, it’s better to wait for them to settle

I hear this one a lot. I understand why people arrive at this view. My take? You can’t afford to sit on the sidelines!

To be sure, multiple sets of AI regulations are taking root at different governmental levels, which adds complexity. But here’s a little secret from someone paying very close attention to emerging AI rulesets: there’s very little daylight between them.

Here’s the thing: regulators worldwide attend the same conferences, engage with the same stakeholders, and read the same studies & whitepapers. And they all watching what each other is doing. As a result, we’re arriving at a global consensus focused on three main areas: data security, transparency, and auditability.

The global AI regulatory landscape is, like any global regulatory landscape, complex; but I’m here to tell you it’s not nearly as uneven or even close to unmanageable as you may fear.

Furthermore, if an additional major change were to be introduced, it wouldn't suddenly take effect. That’s by design. Think of all the websites and digital applications that launched—and indeed, thrived—in the six-year window between when GDPR was introduced in 2012 to when it became enforceable in 2018. Think of everything that would have been lost if they had waited until GDPR was firmly established before moving forward.

My entire career has been spent in fast-moving cutting-edge technologies. And I can tell you from experience that it’s far better to deploy & iterate than to wait for regulatory Godot to arrive. Jump in and get started!

There are more myths to bust! Watch our compliance webinar

The regulations coming are not as odious or as unmanageable as you might fear—particularly when you work with the right partners. I hope I’ve helped overcome some misconceptions as you move forward on your AI journey.

Want to learn more about AI insurance and compliance? Watch the replay of our compliance webinar featuring a discussion between myself; Jason D. Lapham, the Deputy Commissioner for P&C Insurance the Colorado Division of Insurance; and Matt Kelly a key member of Debevoise & Plimpton’s Artificial Intelligence Group. We're discussing the global regulatory landscape and how AI models should be evaluated regarding compliance, data usage, and privacy.

We see responsibility as an absolute must

Responsible AI refers to the practice of designing, developing, and deploying artificial intelligence systems in a manner that is ethical, transparent, accountable, and fair. A rule we live by!

Sixfold is an AI solution purpose-built for insurance underwriting. The platform streamlines the underwriting process, enabling underwriters to focus on decision-making rather than manual tasks. As a result, Sixfold improves the accuracy and transparency of decisions while simultaneously increasing underwriting capacity.

An AI solution, integral to Sixfold's philosophy, ensures ethical underwriting by:

- Preventing bias: It strictly avoids discrimination based on age, gender, ethnicity, or other non-relevant factors.

- Ensuring transparency: The system keeps detailed records of its decision-making for audits and reviews, promoting accountability.

- Informing users: It clearly explains data usage and the rationale behind insurance decisions, enhancing user trust.

- Upholding standards: The AI adheres to all privacy, legal, and ethical guidelines, reflecting Sixfold's commitment to integrity and fairness in underwriting.

Sixfold embodies an AI solution crafted with a deep commitment to responsibility. This dedication translates into a focus on fairness, accountability, transparency, and ethical practices throughout our AI technology.