Sixfold Resources

Embark on a Journey of Discovery: Uncover a Wealth of Knowledge with Our Diverse Range of Resources.

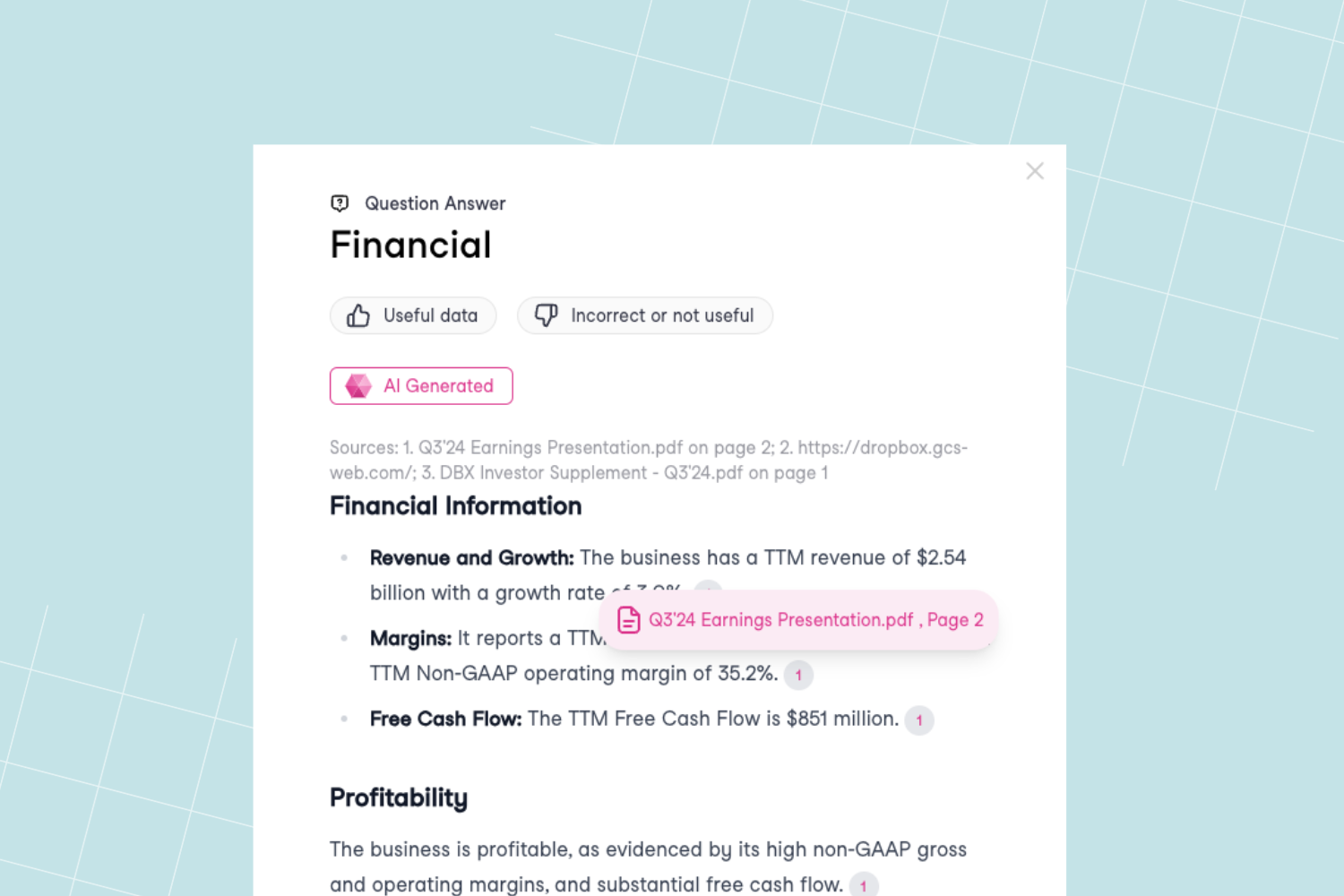

Now Live: One-Click Source Verification for Every Fact

Sixfold’s in-line citation feature is all about building trust and confidence with underwriters by making it effortless to trace the source of Sixfold’s insights. And now, with our latest update we’re making this feature even better!

Sixfold’s in-line citation feature is all about building trust and confidence with underwriters by making it effortless to trace the source of Sixfold’s insights. And now, with our latest update we’re making this feature even better on our commercial platform!

So, what is new?

When reviewing an applicant’s case, you'll notice these improvements:

- Exact Source Page: No more searching through the entire document—now you’ll see the exact page where a fact was found.

- In-line Fact Attribution: Each fact provided by Sixfold will include a specific source citation.

- One-Click Verification: Click any citation, and it will instantly open the source page for you.

It’s now even easier and more intuitive to check exactly where Sixfold’s insights came from—whether a questionnaire, loss run statement, webpage, or any other source. This improves traceability and gives underwriters extra peace of mind. No need to read through a full report or scroll through multiple pages to validate Sixfold’s insights.

“This feature exemplifies our commitment to building trustworthy and explainable AI with elegant simplicity.”

- Drew Das, AI Software Engineer

Get in touch to get a full demo of Sixfold's platform.

Meet the First AI Accuracy Validator Built for Insurance Underwriting

Today, we’re excited to introduce the first-ever AI Accuracy Validator built for insurance underwriting. This application provides customers with a transparent and comprehensive way to evaluate Sixfold’s accuracy—reinforcing our commitment to bring reliable and trustworthy risk assessments to underwriters.

Today, we’re excited to introduce the first-ever AI Accuracy Validator built for insurance underwriting.

This application provides our commerical insurance customers with a transparent and comprehensive way to evaluate Sixfold’s accuracy—reinforcing our commitment to bring reliable and trustworthy risk assessments to underwriters.

Why did we build this?

For an AI solution to truly add value in underwriting, it needs to be both efficient and accurate. Many claim to be both—but is there proof?

For an AI solution to truly add value in underwriting, it needs to be both efficient and accurate. Many claim to be both—but is there proof?

Measuring efficiency can be fairly straightforward—reducing manual work, processing submissions faster, and automating repetitive tasks all provide clear benchmarks. But accuracy? That’s a completely different challenge.

How does it work?

The Accuracy Validator compares Sixfold’s AI-generated insights to the ideal version—what an experienced underwriter at the carrier would expect. It checks for accuracy, scores the results, and provides feedback to improve alignment with human analysis.

Here is a video overview from Lana, Head of Product at Sixfold, on how the validator works:

AI that speaks Underwriter

For AI solutions built for underwriters, accuracy isn’t about finding a single “correct” answer—it’s about reasoning like an underwriter. Take a risk summary as an example, an AI-constructed risk summary shouldn’t just condense information; it should highlight the key risk factors that matter to each carrier.

But what happens if an AI summary leaves out a key risk detail? How do you measure how off it is? What do you compare it to? And when a model is updated, how do you know it’s actually improving accuracy—not just changing the output?

So we started searching for an evaluation tool that could help us answer these questions — but nothing existed.

These were the questions we asked ourselves. So we started searching for an evaluation tool that could help us answer these questions — but nothing existed. It wasn’t just that we couldn’t find the right tool—we realized the industry wasn’t even thinking about accuracy in an insurance-underwriting-specific way.

So, we built it. With this capability in place, we can continuously improve Sixfold’s output, ensuring underwriters receive factually correct, reliable, and actionable insights for every risk assessment.

Benefit #1 - Track progress over time

Evaluating AI accuracy isn’t just a one-time task—it’s about ensuring consistency and continuous improvement. With clear benchmark metrics, insurers can easily track progress and see how Sixfold’s AI aligns with their underwriting standards over time.

Accuracy benchmarks help insurers assess Sixfold’s performance during the pilot phase, ensuring it delivers value to the underwriting team before moving to full implementation.

Considering a Sixfold pilot? Accuracy benchmarks help insurers assess Sixfold’s performance during the pilot phase, ensuring it delivers value to the underwriting team before moving to full implementation. Want to keep tabs on accuracy? No problem. We offer on-demand reports to give our customers a real-time look at how well our AI is performing, whenever they need it.

Benefit #2 - Confident AI adoption

From day one, our goal has been to build an underwriting AI solution that users trust. If underwriters can’t trust Sixfold’s insights, why would they rely on them for critical decisions?

Even in low-stakes tasks, AI’s accuracy isn’t always guaranteed. Take general-purpose LLMs—they handle simple research tasks and tasks such as summarizing reports, but even then, you might find yourself second-guessing their output. They’re right sometimes—but how often? And can you tell when they’re not?

The result? More confident decisions, stronger justifications, and a clearer business case for when to quote—and when not to.

That kind of guesswork isn’t good enough for underwriting. The high-stakes decisions underwriters make every day demand high-stakes trust.

With transparent accuracy reporting, underwriters know exactly how reliable Sixfold’s insights are. The result? More confident decisions, stronger justifications, and a clearer business case for when to quote—and when not to.

Benefit #3 - Audit-ready records

To support insurers’ audit and compliance needs, we conduct regular assessments using this application — both after code updates and at scheduled intervals—to prevent model drift and ensure reliability. This process helps identify inconsistencies and flag any deviations from expected results before they impact underwriting decisions.

The Accuracy Validator generates a transparent, audit-ready log for each assessment, allowing insurers to:

✅ Verify the reasoning behind AI-generated insights and decisions.

✅ Monitor model performance over time to proactively address potential drift.

✅ Demonstrate compliance with regulatory requirements by providing clear, documented AI processes

Feedback from customers

As we’ve started to introduce this capability to insurers, the response has been overwhelmingly positive. Some have even asked if they can use it to evaluate some of their other AI applications — a very clear proof of its value from day one. Others have asked to use the Accuracy Validator outside of AI applications to monitor overall underwriting accuracy.

Another key feedback we’ve received is that no other AI solution offers this level of structured performance measurement and tracking.

Another key feedback we’ve received is that no other AI solution offers this level of structured performance measurement and tracking. Sixfold is the first to give insurers a clear way to validate AI impact and track results over time in underwriting.

Curious to learn how you can get started with Sixfold? Check out the FAQ section to learn more about our pilot program, designed to help insurers fully assess the value of Sixfold before scaling up.

Reach out with any additional questions!

New Features to Revolutionize Life & Disability Underwriting

Our latest Life and Disability AI-powered features focus on overcoming longstanding underwriting challenges and gives a fresh perspective to underwriters.

With our latest product update, we’ve sharpened our focus on Life & Disability via a suite of AI-powered features that overcome common underwriting challenges.

Sixfold’s number one superpower is to easily–and quickly–ingest carriers’ unique underwriting guidelines and automatically surface the submissions that match the carrier’s unique risk appetite. Moreover, the platform empowers Life & Disability carriers to streamline the underwriting process by:

🔘 Ingesting data from multiple disparate sources in an instant

🔘 Generating a comprehensive summarization of the applicant's health history and lifestyle within minutes

🔘 Surfacing positive & negative risk signals aligning with the unique risk appetite of each carrier

🔘 Triaging submissions with an underwriter-facing dashboard for improved resource allocation

We've significantly broadened our Life & Disability offerings by expanding into six key areas, facilitating us to quickly create a comprehensive 360-degree applicant profile in just minutes by:

✔️ Reducing manual workload through improved document ingestion

Our technology has been significantly enhanced to process and analyze an extensive history of lab results, diagnoses, and medication records, covering years or even decades.

The platform is proficient in ingesting data from various sources including APS files, MIB reports, labs, applications, supplementals, Electronic Health Records (EHR), and Fast Healthcare Interoperability Resources (FHIR) files. By automating the ingestion of these diverse data types, Sixfold eliminates the need for manual document handling by underwriters.

✔️ Refining risk evaluation with a holistic view of medications, treatments, lifestyle choices, and family history

The platform leverages advanced synthesis of adjacent applicant history information, including pertinent family medical histories and lifestyle attributes, to offer a comprehensive understanding of their broader health habits and disease predispositions.

By integrating details from submitted records—such as family diagnoses ("father was diagnosed with melanoma at 63, but was successfully treated")—with insights into exercise routines ("engages in moderate-intensity aerobic exercise and weight lifting"), hobbies ("applicant scuba dives several times per year"), and substance use ("consumes a few beers every few days"), Sixfold provides a holistic view of an applicant's health.

This comprehensive approach enhances the precision of assessments, enabling more informed decisions regarding risk.

✔️ Improving risk decision precision with in-depth analysis of health condition progression

We are now able to aggregate data related to a condition, including adjacent factors like medication, to chronologically track the comprehensive progression of the condition across multiple data sources. By utilizing detailed health data and its evolution over time, we enable more informed and accurate underwriting decisions.

This approach provides a unique layer of detail, incorporating crucial health information over time, allowing underwriters to quickly grasp risk with relevant context, thereby informing more precise rating and pricing.

✔️ Enhancing fraud detection by identifying inconsistencies across sources

Underwriters are tasked with synthesizing and managing a vast amount of information from lengthy documents, including Attending Physician Statements (APS), self-reported data, laboratory results, and more. An important aspect of analyzing these documents is to identify inconsistencies or discrepancies that could arise from oversight or fraud. Instead of solely relying on underwriters to detect irregularities across diverse documents, Sixfold proactively identifies and flags these discrepancies to the underwriter.

The platform's automated capability to identify problematic areas empowers underwriters to make informed decisions, leading to more accurate pricing of premiums and greater reliability of applicant information, safeguarding both insurers and applicants.

✔️ Expanding traceability with full document and page number sourcing

Our recent achievement of SOC 2 Type 2 certification underscores our commitment to being a responsible AI solution.

In this release, we've taken traceability to the next level by ensuring underwriters have access to complete information sourcing, pinpointing the exact document and page for increased transparency and accuracy.

✔️ Boosting underwriting capacity with upgraded triaging functionality

Sixfold's latest update introduces a streamlined dashboard experience, designed specifically to empower underwriters to efficiently prioritize applicants who meet their risk tolerance and gracefully set aside those who do not. This effectively addresses the common 'front door issue' in Life & Disability underwriting, which involves managing an overwhelming influx of submissions by automating the pre-processing of applications. Within minutes, Sixfold accurately identifies and aligns applicants with the carrier’s risk criteria, significantly easing the burden of manual sorting and enabling underwriters to focus on the most suitable cases.

Our newest updates equip life & disability underwriters with a complete, clear and accurate health snapshot for every applicant, pinpointing key data points without sacrificing our commitment to compliance and data privacy.